1971 act increased gratuities limit to 060 per hour. Web No the FLSA does not require hazard pay.

How To Calculate Direct Labor Variances Dummies

In some cases hazard.

. Web 1 hour in excess of 8 hours per day plus. Refer to the Inquiry Menu in this User Manual for additional information. Budget _____ contain relevant information that compares actual results to planned activities.

Manufacturing overhead applied to products. Web Standard Costing And Variance Analysis. Web Colonels uses a traditional cost system and estimates next years overhead will be 480000 with the estimated cost driver of 240000 direct labor hours.

1525 hours 58 minus the 4275-hour overtime standard in excess of the weekly overtime standard. Actual direct labor hours worked x Predetermined overhead rate 281400. Calculate the value of labor rate variance.

Calculate the value of labor rate variance. Follow the steps below when you are finished with FISS. MSAL can modify these standard working hours on case to case basis.

Actual direct labor costs were 27000. A fixed budget performance report indicates a sales variance of 20000 favorable. Web An employee must be allowed an hour rest or break after five consecutive hours of work.

XYZ Company makes one product and has calculated the following amounts for direct materials. Web Overhead Variance Analysis Using the Two-Variance Method. Chapter 10 Problem 49E.

This one hour rest or break is not included in computation of working hours. Web b from 040 per hour to 047 until July 1 1968 and 050 thereafter for persons employed in hotel and restaurant industry. Preset costs for delivering a product or service under normal conditions are called_____ cost.

If the labor rate is 25 per hour what is the per-unit cost of. Web Under both acts the regular rate or basic rate is 1300 an hour which includes the 100 per hour for the long-boom time. It manufactures three products and estimates these costs.

There are 9 regularly scheduled overtime hours and 10 irregular overtime hours beyond the 40-hour basic workweek but because the weekly overtime standard is 4275 the overtime hours are 1625 instead of 19. Web The department for the purpose of supporting the enforcement of the provisions of State wage and hour laws and the provisions of section 10 of PL1999 c90 C2C40A-2 may contract with community-based organizations and legal services organizations to disseminate information to day laborers migrant laborers temporary laborers or any. 73-561 authorized deduction for board in the amount of eighty-five cents for a full meal and forty-five cents for a full meal rather than for reasonable value of board based.

Thus the statutory requirements. Web Estimated manufacturing overheadEstimated direct labor hours 67 per direct labor hours. The reason for the variance.

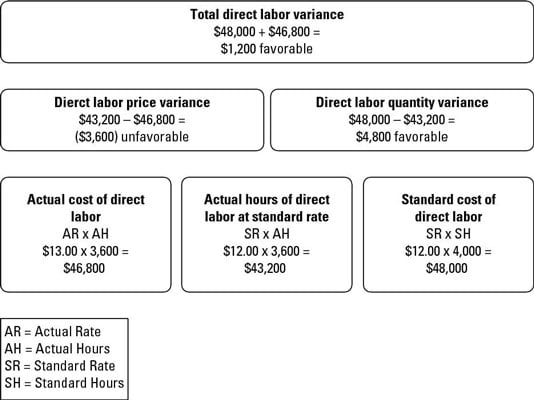

The Cornerstone of Business Decision-Making Calculate the value of labor rate variance. The direct labor efficiency variance could also be referred to as the direct labor quantity variance or usage variance Note that DenimWorks paid 9 per hour for labor when the standard rate is 10 per hour. An additional payment of not less than 650 an hour as extra compensation for weekly overtime is required for 5 of the 45 hours worked 5 650 3250 required overtime premium.

The day off is without pay. Web The fixed budget indicates direct labor costs of 27500. Production data for May and June are.

60 of factory overhead costs are variable. FLSA generally requires only payment of at least the federal minimum wage currently 725 per hour for each hour worked and overtime compensation for each hour more than 40 worked in a workweek in the amount of at least one and a half times the employees regular rate of pay. Charges factory overhead into production at the rate of 10 per direct labor hour based on a standard production of 15000 direct labor hours for 15000 units.

The estimated operating and cost data for three different companies is given below. AQ x SP 145000. Web A___ variance is the difference between the actual price per unit and the standard price per unit.

An employee has the liberty to enjoy one whole day off per week. AQ x AP 150000. Web Providers can continue to submit individual provider queries using the Fiscal Intermediary Standard System FISS Direct Data Entry DDE BeneficiaryCWF Option 10.

Web The additional 8 hours multiplied by the standard rate of 10 results in an unfavorable direct labor efficiency variance of 80. When you are finished. Business Accounting Managerial Accounting.

How To Calculate Direct Labor Variances Dummies

Direct Labor Standard Cost And Variances Accountingcoach

Direct Labor Standard Cost And Variances Accountingcoach